| Fake or Fortune and the 'Non-Fungible Token' | ||

| fungible : of goods or commodities, freely exchangeable for or replaceable by another of like nature or kind. This essay is written by me. It is an example of my writing style and uses my normal vocabulary in a way common to all my essays. I would hope that you will find that, thanks to spell-check, it contains no spelleing mitsakes and that because of my grammar school education it uses apostrophe’s correctly. But this essay is unique despite the features it has in common with my other essays. I have not written another using the same words in the same order. How though can you be sure that it is mine? We could look at my somewhat idiosyncratic style, but that is easily imitated. Instead, we could perhaps look at provenance. This is essentially a matter of probability. As no money is involved, it is unlikely (the Bayesian prior probability) that anyone-else would want to pretend to be the writer of my essays. Secondly, it has appeared on this, my own web-site. So then it is even more unlikely that someone-else would have bothered to hack my domain in order to carry off the deception. So, I think it’s a pretty safe assumption that it’s a genuine Paul Buckingham. What a relief! From our watching of ‘Fake or Fortune’, however, it’s obvious that things are not always quite so clear when real money is at stake. If during his lifetime someone is recognised as a great artist, he will inevitably have gathered around him a group of workers in a studio. They will be needed to help him produce the works of art on the scale or in the quantity required. It happened in the olden days and happens today. This then leads to questions over the degree of input into the work produced by the ‘name’ – a question much to the fore in the debate over the Leonardo da Vinci work ‘Salvator Mundi’. Despite the price of $450 million dollars recently paid for it, we now hear that no-one is actually sure whether Leonardo contributed ‘a few strokes’ to a work produced by worker ants in his studio or whether it was overwhelmingly the direct result of his genius. And then, paintings are often ‘restored’. In the hands of people who are often less than experts, they can lose the originality which was once theirs. They become almost unrecognisable as works of the original master: despite scientific analysis, lingering doubt is often left, even when cleaned, as to quite who the painter actually was or even what he actually painted. Things are even more difficult when looking at a work produced in his early years by someone who became famous posthumously. Often, the recording of his output is not very good and, even when living in a garret, it was quite common for other equally impecunious artists to share space, materials and models and even trips out to paint the same landscapes. Such artists were usually part of the same art movement and so painting in a similar style. Which means that there is often ample cause for confusion of attribution, even before coming to actual forgeries. And then the whole system of attribution for the art world seems to depend on self-appointed committees, operating in a far from transparent way. So then, it’s all deeply unsatisfactory. But now we have a new category of art: the digital artwork, giving the possibility of apparently undeniable attribution by way of ‘non-fungible tokens' (NFTs). We have seen that these artworks can go for prices previously only  attracted by

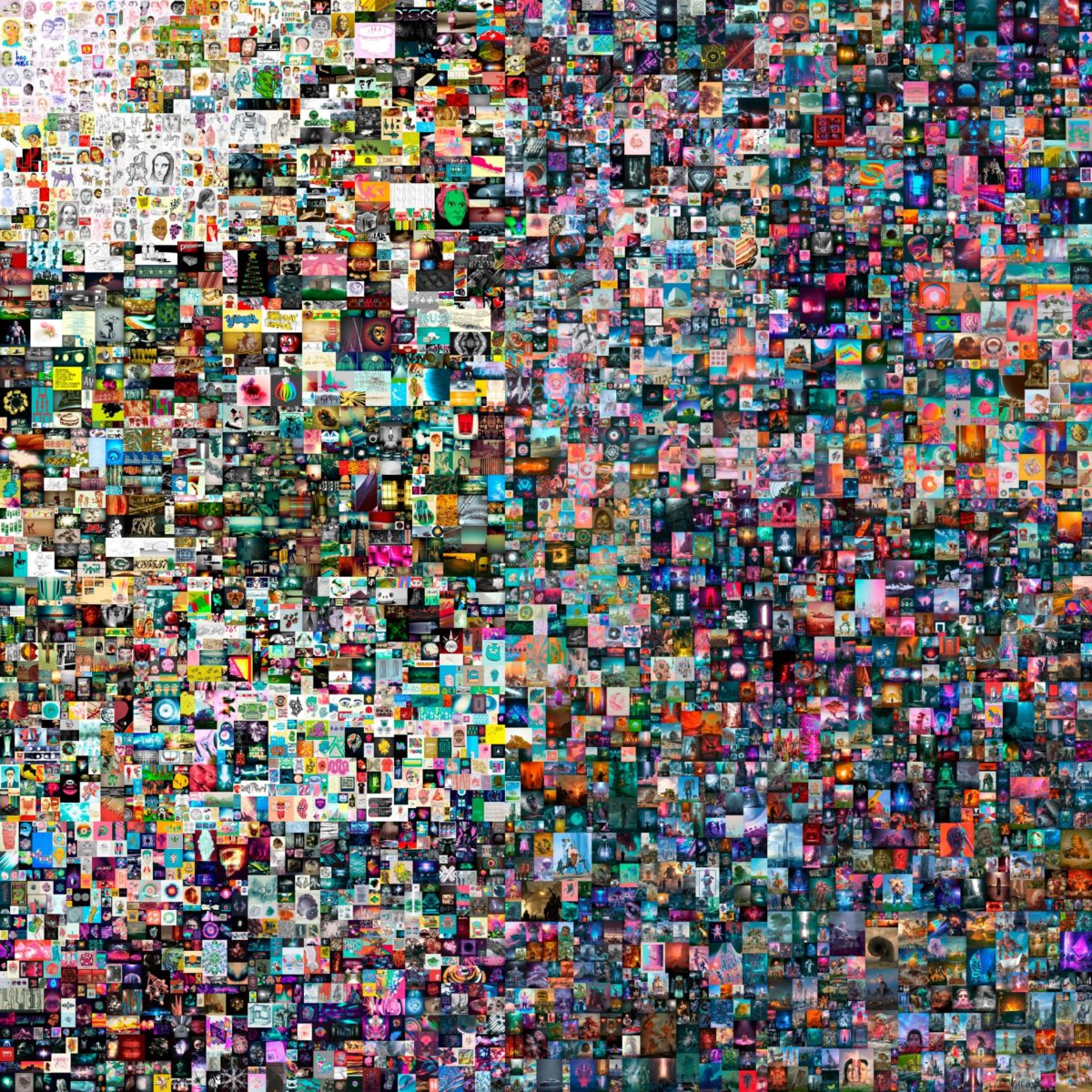

famous (analogue) artists. The collage of

digital designs by the artist known as Beeple

created over, it seems, 5,000 days was

recently sold for $69 million, or just over

$13,000 for each day’s work. Not bad. A few

weeks after the Beeple sale, the musician

Grimes sold some of her digital art for more

than $6m. And it’s is not

just digital art that is tokenised and sold.

Twitter's founder Jack Dorsey has sold his

first-ever tweet, with bids hitting $2.5m. attracted by

famous (analogue) artists. The collage of

digital designs by the artist known as Beeple

created over, it seems, 5,000 days was

recently sold for $69 million, or just over

$13,000 for each day’s work. Not bad. A few

weeks after the Beeple sale, the musician

Grimes sold some of her digital art for more

than $6m. And it’s is not

just digital art that is tokenised and sold.

Twitter's founder Jack Dorsey has sold his

first-ever tweet, with bids hitting $2.5m. But if, in turn, you wanted to become the actual 'owner' of the NFT representing, say, Beeple’s collage, then you would have to be registered by the artist as the new owner. You would of course have to pay the present owner, whose identity is assured by reason of the nature of block-chain technology - essentially a database housed on a myriad computers, which makes fraudulently changing the data on every one of them all but impossible. But what is different is that a percentage of the price paid would go to Beeple. And it is the NFT which enables, requires that this happens. The NFT not only denotes ownership, but also the percentage which will have to be paid to the artist in order for the work to be re-registered to the new owner. so then an ancillary purpose of the NFT is to secure an income stream for the artist. This was something which was never possible for the likes of, say, Renoir. Once sold, his painting ceased to have any value for him save as publicity when friends of the buyer saw it. If though a digital artist, at the outset of his career, creates an artwork which sells at a modest price, but has embedded in it a suitable NFT, then every time ownership is transferred, a percentage of the sale value goes to the original artist. If the value goes stratospheric then the artist always gets his cut. Or so the theory goes. What happens if payment is made partly through the NFT system but mainly outside it, I have no idea. I can’t see how that could be guarded against. The question left hanging, however, is precisely what the buyers have bought. Jack Dorsey’s first tweet is, after all, widely available on the web. Millions of people have seen the artwork by Beeple online and the original image has been copied and shared countless times. Obviously a new digital work of art can be shown privately, and not on the web, but this is not typically how people gather a following in order to make their works popular, and so valuable. They need to go on show. The NFT system ultimately depends then upon a desire to be the true owner of something to which there is every likelihood that everyone-else has essentially the same access. They can get it by way of a screen grab. In many cases, the artist even retains the copyright ownership of their work, so they can continue to produce and sell copies, although obviously not able to attach an NFT to any of them....? As with crypto-currencies, there are concerns about the environmental impact of maintaining the blockchain – the amount of computer power required is quite formidable. But just like cryptocurrencies, there are concerns that NFTs may be just a bubble. As the BBC web-site tells us, the day before his record-breaking auction, Beeple - whose real name is Mike Winkelmann - told the BBC: "I actually do think there will be a bubble, to be quite honest. And I think we could be in that bubble right now." And so we return to the difficult questions of ownership, uniqueness and authenticity. David Gerard, author of Attack of the 50-foot Blockchain, said: "There are some artists absolutely making a mint on this stuff... it's just that you probably won't," he warned. The people actually selling the NFTs are "crypto-grifters", he said. "The same guys who've always been at it, trying to come up with a new form of worthless magic bean that they can sell for money." Former Christie's auctioneer Charles Allsopp said the concept of buying NFTs made "no sense". "The idea of buying something which isn't there is just strange." So then, I don’t think that I shall be ‘investing’ in NFTs any time soon. But if you click on this LINK, you’ll have indisputable confirmation that this essay is by me - well, perhaps. Paul Buckingham 20 April 2021 |

||

|

|